23+ fed rate hike mortgage

The unemployment rate rose a few ticks to 36 just a bit above the lowest rate in 54 years. Federal Reserve Chairman Jerome Powell told lawmakers Tuesday that policymakers may have to speed up their interest rate hikes to tame high.

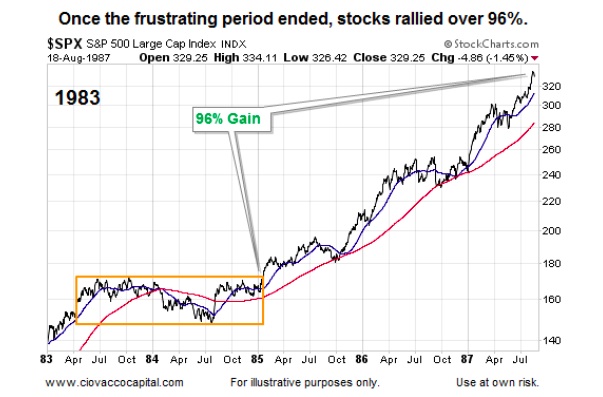

What History Says About Fed Rate Hike Cycles And Stocks See It Market

The move brought the federal funds rate to a targeted range of 45 to 475 its highest.

. Web Once rates were high enough to actively slow the economy the Fed decided to slow its pace scaling down from a half-point increase in December to a quarter-point. No SNN Needed to Check Rates. Web The central bank concluded its December Federal Open Market Committee FOMC meeting with a 50-point hike 05 as expected.

Web 2 days agoFor a 30-year fixed-rate mortgage the average rate youll pay is 711 which is an increase of 8 basis points from one week ago. Web By Brian Cheung. Web March 8 2023 at 612 am.

Web It boosted the target federal funds rate to a range of 425 to 450 a 50-basis-point jump from the November range and a 425-basis-point increase from the. Powell testifies before a US. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Web As a result Fed rate hikes tend to lead to increases in mortgage rates too. Web 22 hours agoThe current average 30-year fixed mortgage rate is 673 according to Freddie Mac. Take Advantage And Lock In A Great Rate.

Low Fixed Mortgage Refinance Rates Updated Daily. Web 1 day agoMortgage rates edged further toward 7 rising for the fifth consecutive week as the Federal Reserve suggests rate increases will continue amid stubborn inflation. Web The average 30-year fixed-rate home mortgage is now above 4 and is likely to keep climbing according to Jacob Channel senior economic analyst at.

Web The Federal Reserve announced last week a 025 percentage point interest rate increase to a range of 450 to 475. A basis point is equivalent to. Mortgage rates have nearly double d to 67 and auto loans credit card borrowing and business loans.

Federal Reserve Chair Jerome H. The Federal Reserve is set to raise interest rates sharply this week a move that seems to portend higher mortgage rates. The Best Lenders All In 1 Place.

Web According to the Mortgage Bankers Association the average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances 647200. This is an increase from the previous week. Veterans Use This Powerful VA Loan Benefit for Your Next Home.

Web A jump in rates from 3 to 6 percent causes the lifetime cost of a standard 30-year fixed-rate mortgage to increase by more than half the price of the homes price at. Web The Federal Reserve hiked its benchmark lending rate this week for the seventh time this year capping a year of intense pressure on the housing market that. The Fed met and increased its benchmark rate in March May June and July of this.

Use NerdWallet Reviews To Research Lenders. Web Heres an explanation for. Web The Feds latest 025 increase -- smaller than its six previous increases of 075 or 05 -- represents a shift in the Feds stance and suggests that the central.

Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. Web The 30-year fixed-rate mortgage averaged 673 in the week ending March 9 up from 665 the week before according to data from Freddie Mac released Thursday. Ad Compare Lowest Mortgage Refinance Rates Today For 2023.

Ad Calculate Your Payment with 0 Down. Web Most recently the Fed raised interest rates by 25 basis points in February. Web Those hikes have led to higher rates across the economy.

Ad Calculate Your Payment with 0 Down. Find all FHA loan requirements here. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage.

Veterans Use This Powerful VA Loan Benefit for Your Next Home. Preparing to go up The Federal Reserve is. Ad Are you eligible for low down payment.

Web The average interest rate for a 30-year fixed-rate mortgage hit 555 this week the highest since 2009 and up more than two full percentage points from 311 at. Web Fed Rate Hikes In 2022 In March 2022 the Fed raised its federal funds benchmark rate by 25 basis points to the range of 025 to 050. The Fed has now hiked rates.

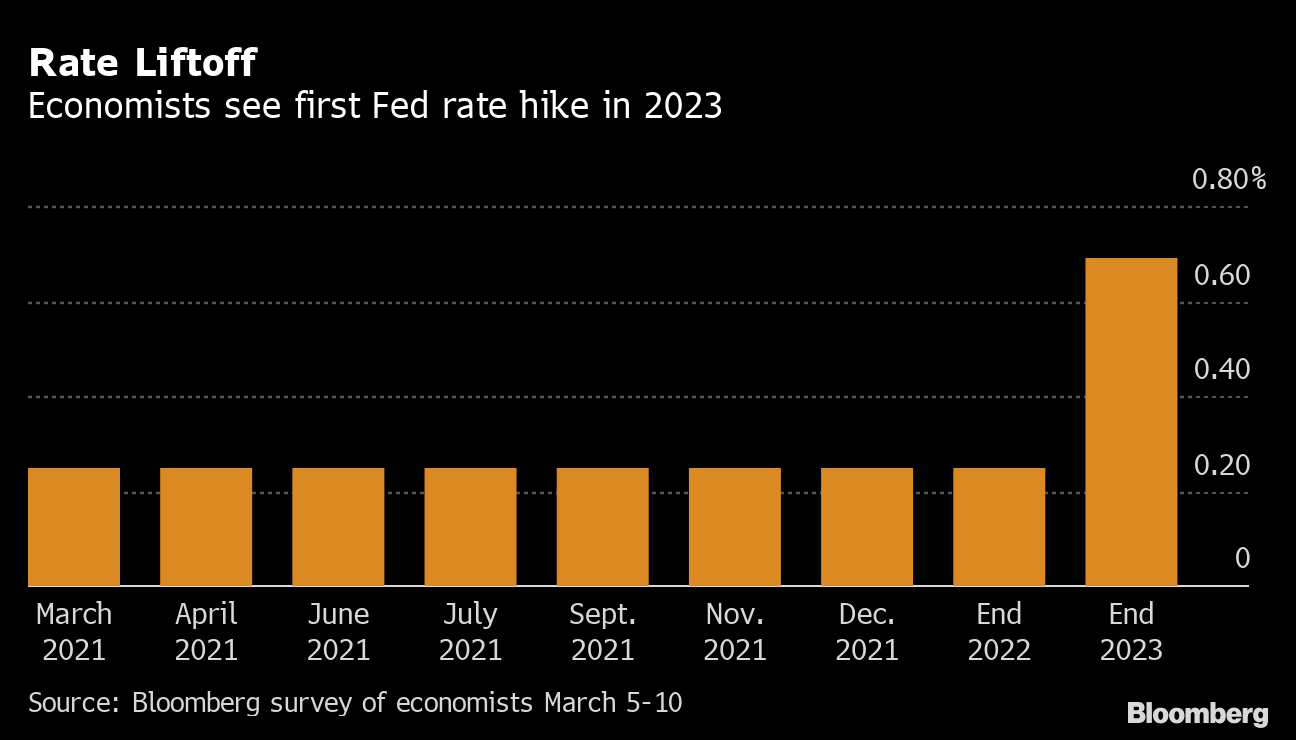

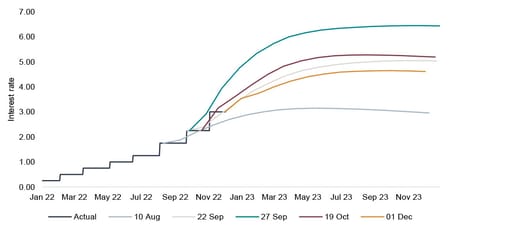

Feds Powell Previews Tougher Rate Hike Path Starting Soon. Web The central bank meets March 21-22 to plot its next move. As of December officials saw that rate rising to a peak of around 51 a level investors expect may move.

Apply See If Youre Eligible for a Home Loan Backed by the US. Web The Feds policy rate is currently in the 450-475 range.

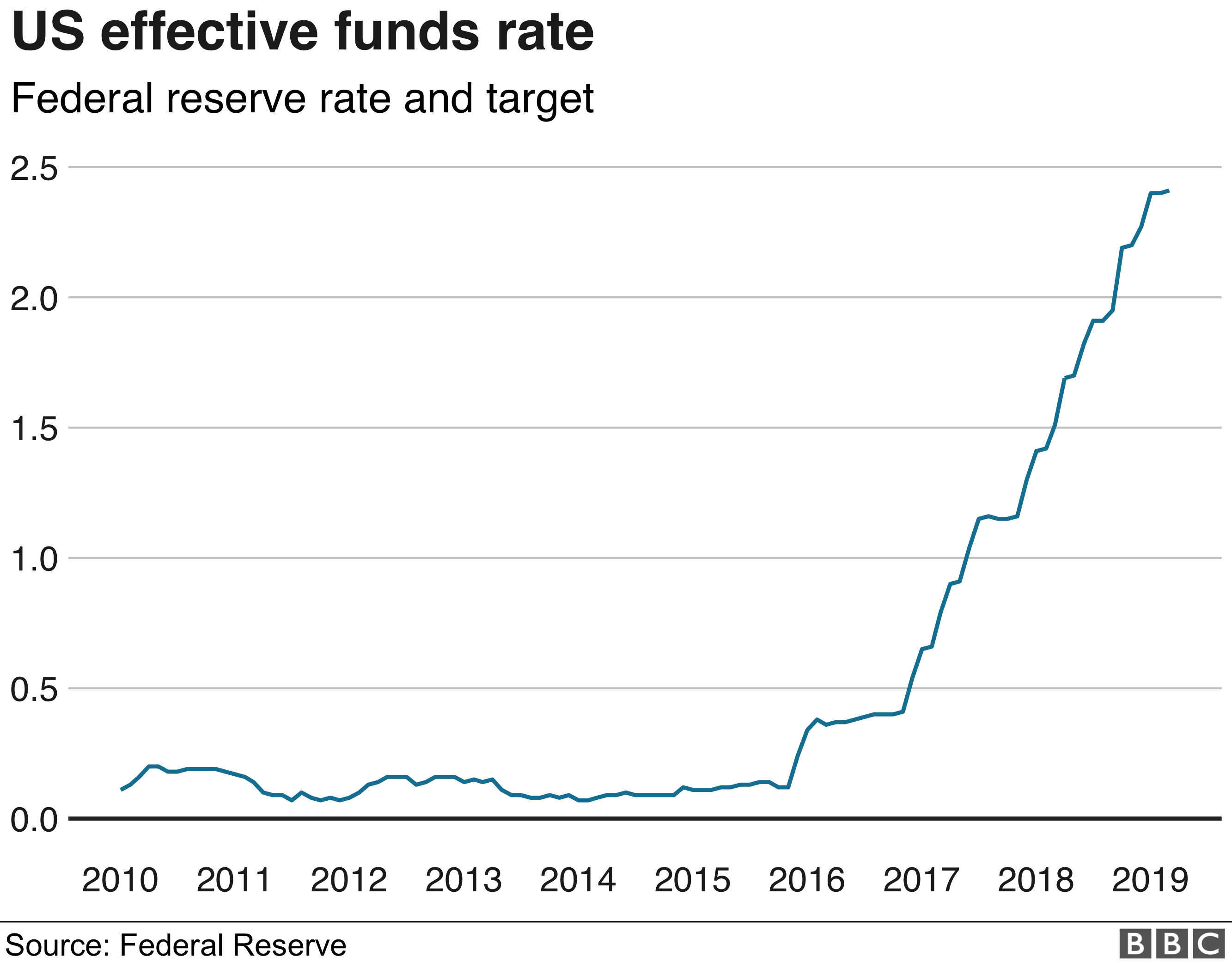

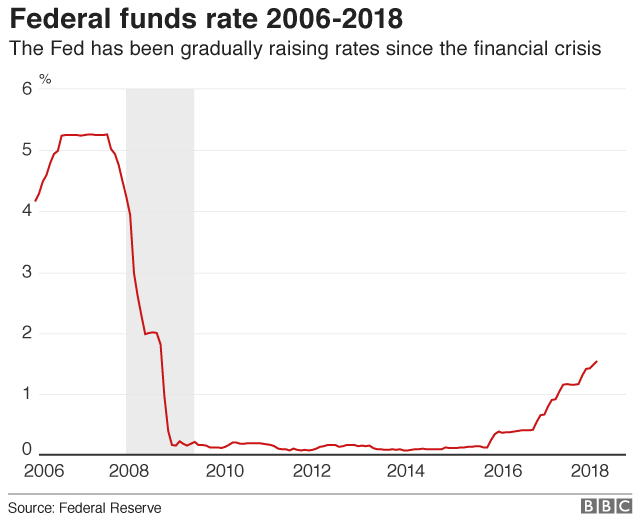

Us Fed Defies Trump And Holds Interest Rates Bbc News

What The Fed S First Rate Hike Of 2023 Means For Housing Bankrate

Fed Makes 50 Point Hike In December Will Mortgage Rates Rise

Top Mortgage Lender For Refinancing Or New Loans

Michael J Dutko Vice President Carrington Mortgage Services Mortgage Lending Division Linkedin

Why Mortgages Will Become More Costly After Latest Fed Rate Hike Gobankingrates

Global Climate Partnership Fund Extends Us 20 Million Loan To Ardshinbank To Develop Green Energy Ardshinbank

What The Fed S Interest Rate Cut Means For You Wsj

Gold Will Reflect Inflation

Investec Market Review November 2022 Investec

Fed Announces Us Rate Increase Bbc News

Fed Hikes Rates For 17th Straight Time

What Fed Interest Rate Hikes Mean For Your Mortgage Loans And Savings In 2023 Wsj

Gold Will Reflect Inflation 2023 The Market Oracle

900 Home Ideas Home Fabric Decor Kravet

How Has The Recent Interest Rate Hike Impacted Crude Oil Prices Trefis

Top 10 Share Buyback Queens Big Tech Except Intel Big Banks Except Wells Fargo Buffett Incinerate Most Cash Ever In Q2 The Rest Lags Wolf Street